When to Start an

Urban Community Land Trust

Last Updated: May 31, 2024

An urban community land trust most commonly is conceived of and operated as a method of keeping housing affordable permanently, although acceptable price points vary widely.

To explain the concept in simplest terms, some experts say that any land set aside in perpetuity for a specific purpose is a community land trust (CLT). While we agree with that notion, in practice when leaders and residents involved in creating a good community use the term, the idea becomes much more specifically housing-related.

In this article we explain this complicated idea, narrowing the focus to an urban community land trust that creates or preserves housing and also provides supportive services or amenities.

At the end of the article you will find what you cannot find elsewhere, which is our opinion of whether you should even work on this. If you fully understand the concept and its variations, jump ahead to the last heading.

If this is a new idea for you, we provide enough background that you can discuss this concept intelligently at your next neighborhood or town meeting.

How Does an Urban Community Land Trust Work?

An urban community land trust owns land and then enters into a long-term lease (often 99 years) to a member, who may or may not own the housing unit on the land. A member who owns a home then functions much like a typical homeowner--driving nails, making noise, painting the walls, adding a bathroom, and generally improving the home at will without having to ask anyone's permission.

The subtraction of land cost from the purchase price of course makes the home more affordable to the buyer.

A member who rents a home from the land trust experiences a typical landlord-tenant relationship, possibly with a few wrinkles that we will explain below.

When a member-owner wants to sell a home on urban community land trust property, rules of the land trust govern sales price and conditions. Usually there is a limit on the amount of equity that can be accumulated. Members are compensated for their expenses in maintaining and improving the unit, often following a prescribed formula that also allows for inflation.

However, the housing affordability goal means that the land trust takes a shared-equity approach; the land trust must prevent steep increases in the cost of housing. The tricky part is incentivizing quality maintenance and improvements while still keeping prices reasonable, whatever that may mean for a particular organization.

Typically the urban community land trust itself is the guaranteed purchaser of a unit that the building owner wants to sell, or it may have a "right of first refusal" to purchase when a housing unit is put up for sale. In all cases, the income of future purchasers is limited so that higher-income folks don't just game the system.

We didn't say that this was a simple concept, so keep reading to pick up more essential points.

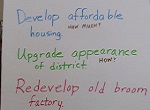

How Does a Community Land Trust Start?

The trust typically forms as a result of either a community campaign to create this ownership form, or through the efforts of an existing social service agency, place-based community development corporation (CDC), or community action agency. Usually it becomes a separate nonprofit corporation, and in the U.S. this means one that receives the IRS designation known as 501(c)3.

Usually open memberships are sold to people who have no intention of living there but who support the socially beneficial goals of the project. Home buyers and tenants become members too. The land trust membership commonly participates in choosing its board of directors, or the board may be self-perpetuating, as would be common in other nonprofit corporations. Often public officials become part of the governing board as well.

After its formation, an urban community land trust may then purchase or receive donations of vacant land, a redevelopment site, or existing housing that it wants to preserve or upgrade. Methods of acquiring land commonly include government grants of money or publicly owned land and buildings, simple or complex government subsidies, donations of land from private individuals, and opportunistic purchases of foreclosures, short sales, heir property, or other quick sale situations.

By our use of the terms "social service" and "housing affordability" you may be getting the impression that the urban community land trust serves only low-income people. Certainly that is one worthy application, but addressing runaway housing prices in areas of high demand is becoming a much larger share of the activity.

Occasionally a local government takes the lead role in forming the urban community land trust. For an example, the City played an organizing role in what was originally called the Chicago Community Land Trust, and provided staff support in the early years. This has now evolved into a somewhat different structure and emphasis and is now called the Chicago Housing Trust.

Where's the "Community" in Our Community Land Trusts?

Sometimes organizers begin with an expectation that members act similarly to members of a neighborhood association or homeowner association and may participate actively in is governance, social activities, and selection and programming of any social services or common projects. Sometimes this does not happen, and members view the trust as simply a way of buying a home. The relentless need to pursue grants, external funding, and more and more land purchase often leads to professionalization of the CLT and a minimal or declining role for actual building up community feeling and teamwork among residents.

If you intend to foster relationship among residents, be quite intentional about building in ways and places for them to interact. Obviously this will be easier if the land trust's properties are contiguous and the area compact.

Types of Housing That a CLT May Develop or Rehab

Variations are as infinite as the local housing market. Homes may be contiguous (next to one another) or scattered throughout a community. New construction is usually easier for both the for-profit and nonprofit sectors, so often it is emphasized. To keep costs as low as possible, the CLT might partner with a local Habitat for Humanity chapter, which employs a partial sweat equity model to help control costs. Or the land trust itself could invent a sweat equity program.

However, rehabilitation of existing properties is also a worthy mission or project for an urban CLT. These then could become owner-occupied or rental units.

Rental housing is often physically indistinguishable from owned housing units, although apartment buildings certainly could be a community land trust project. Usually all rental housing in the project is owned by the urban community land trust, or alternatively by resident building owners and members who want to become landlords. Absentee landlords are not allowed. Even homeowners who want to leave cannot become landlords; they must sell.

Given the home ownership thrust of many land trusts, they might choose to provide a rent to own or option to buy program, whereby a part of a tenant's rent counts toward the eventual purchase price .

Specialized housing types may be developed. Senior housing, disabled housing, programs to end homelessness, or accessory dwelling units for one-person households all could be part of the mix.

The community land trust could become a cluster housing development, combining the housing element we are discussing here with elements of a conservation-oriented land trust.

Financing the Community Land Trust

In the past, financing of land purchase and housing construction or acquisition was a huge obstacle. In fact, one exploratory committee that I was involved with found the task so daunting that ultimately we gave up. Fortunately today it is a bit easier.

Some state housing finance agencies now assist with financing, and Fannie Mae and Freddie Mac have thrown the mighty weight of their mortgage guarantees behind the movement. Many buyers are eligible for FHA-insured loans or VA loans. The key to all of those loan guarantee or mortgage purchase programs though is finding a willing lender approved for these programs. If a lender lacks experience with community land trusts, a considerable education process often is necessary.

In the past the Institute for Community Economics was enormously helpful in assisting in project financing. Today that work continues at the National Housing Trust. (This organization is local to Montgomery County, Maryland, but also lends nationally.) Despite these advances it is imperative that the land trust have either a good chunk of land or nice pile of cash to start up.

Like all nonprofits, the community land trust may undertake some projects that raise a considerable amount of money, which in turn is invested back into the qualifying nonprofit purpose. For example, some community land trusts have taken to flipping houses within or adjacent to their own boundaries.

As stated above, they also may rent houses to a resident member who wants to be a landlord, arranging a little profit center for the trust while avoiding the day-to-day headaches of being a landlord itself.

They also could sell a portion of the trust's land to a developer who wishes to create a subdivision or a PUD (planned unit development), providing the conditions agreed to when the land was acquired are met.

Better yet, if the legal situation allows, the urban community land trust could even act as a developer itself, although it may feel that participation in a rapidly appreciating real estate market would violate core values.

Lastly, a minor source of income is a ground lease fee that the community land trust charges a homeowner or rental unit owner. To preserve affordability, leases vary from 1 U.S. dollar a year to 100 dollars a month.

Administering An Urban Community Land Trust

Almost every urban community land trust will need to employ at least a part-time staff member to administer the resale formula, among other tasks. The resale formula may factor in appraisals at both purchase and resale, a predetermined index of affordability in comparison with housing prices in the broader community, the documented expenses of the unit owner, or a combination of these.

Because of the need for staffing. the trust charges building owners a lease fee for the land, allowing it to have the needed resources to hire this person. Often too the urban community land trust voluntarily pays property taxes to be fair to the local government; the lease fee thus needs to be high enough to cover that expense as well.

Resale conditions may be delineated in either the ground lease or possibly in deed restrictions, which some urban community land trusts are employing instead of permanent land ownership. (We won't get into the debate about whether the traditional method we have been describing is better or worse than simply setting up deed restrictions, except to observe that leases are easier to change and track than deed restrictions.)

When you are ready to digest more about financial and administrative issues, we suggest a resource page from Grounded Solutions, as well as a model allowing comparison of shared appreciation formulas from Street Level Advisors.

Comparing Community Land Trusts to Similar Concepts

A related concept is limited equity homeownership, which may or may not be carried out by a nonprofit, membership-led, community-oriented corporation. Occasionally governments and private developers become involved in such systems that restrict price increases also. However, these may or may not involve land ownership by a controlling entity, with required lease payments for the land.

The housing co-op, a shared appreciation arrangement between owner and co-op corporation, also is related. However, a co-op, fairly common in New York City, may be strictly a business proposition and sometimes a snobbish one at that. The community land trust ideally is much more community-minded and community-supported.

For example, a community land trust typically will hold both fundraising events aimed at the broader community and informational outreach events for the community. Members from the broader community participate in decision making. Now in the city with stratospheric real estate prices, the urban community land trust fundraiser may be a wine and cheese party, but still, it involves inviting the broader community's fundraising and moral support. That won't happen in Manhattan co-ops!

Should You Start a Community Land Trust?

True to our style, our conclusion about community land trusts is pretty down-to-earth. In our opinion, these only work in one of two situations:

- The local real estate market is strong and already high prices are accelerating rapidly. You might be a future Vail or Aspen or Jupiter Island, or just a suburb enjoying popularity. If your housing rental and purchase prices are sky-high, your supply is constrained by geography, and essential workers cannot afford a place to live within a reasonable commute, it is your land price, not your building price, that fuels the frenzy. You can stop that by in effect holding the land price constant through forming a land trust. In these types of areas, an urban community land trust could be paired with a municipal inclusionary zoning ordinance to help keep prices down.

- Your target population is a mix of low-income and very low-income people for whom you would like to foster home ownership while providing the skills training or social services necessary to lift economic circumstances. In that case, if you can locate stable and reliable financial resources, you may be able to succeed. In this instance, land prices may not be rising fast, if at all, so you should scrutinize very closely indeed what you hope to accomplish by starting an urban community land trust as opposed to engaging in other forms of housing subsidy or home ownership counseling and assistance.

We want to make one additional point about the CLT in a low-income neighborhood. As we have indicated, the land trust will need an administrator, so you have to ask yourself if the end result is worth requiring your least prosperous residents to lease land, plus paying rent or a mortgage. (Alternatively, you may have excess staffing capacity, making this a non-issue.) If you are sure you have enough organizational capacity, foundation or government support, or potential for prosperous real estate deals, the community land trust can make sense in a lower-income urban environment.

If your idea does not fall within the two above categories, please just exercise extra caution in exploring feasibility. Note that in this article, we have not explored rural or small town environments; where the need for preserving affordability is strong, we definitely endorse community land trusts in these settings. We also like CLTs for conservation or sustainability purposes. We hope to write about that separately soon.

If you are still considering this shared-equity home ownership option, you will want to read case studies, learn from examples, and visit nearby staff members. The Schumacher Center for a New Economics maintains a list of CLTs, including both urban and rural entities, organized by state.

The Lincoln Institute of Land Policy, another organization interested in this policy arena, has just released a 2022 survey of CLTs and similar organizations. If you are serious about this concept, you should dive in.

Read More to Decide Whether to Do This

- Making and Keeping a Good Community ›

- Housing Issues › Community Land Trusts in an Urban Setting

Join GOOD COMMUNITY PLUS, which provides you monthly with short features and tips about timely topics for neighborhoods, towns and cities, community organizations, and rural or small town environments. Unsubscribe any time. We expect to send just one more issue before we abandon this website and move to other projects. Sign up to see our final words of wisdom.